Basic Concept

ZOZO Group have the basic policy of management for continuous improvement of corporate value and establish better relationships with all stakeholders including shareholders by constantly focus on integrity, transparency, efficiency and promptness of corporate management. In order to realize this, we are enhancing the corporate governance centered on the Board of Directors and audit committees.

Please refer to the following materials for our initiatives in the Corporate Governance Code (Updated on June 28, 2022).

Corporate Governance Code

As for the Corporate Governance Report, please refer to the following link (Updated on June 28, 2022).

Corporate Governance Report

As for more information on the Corporate Governance Code and its implementation status, please refer to the following link.

Corporate Governance Code Content Index

Matters Concerning the Executive, Audit and Oversight, Nomination, Remuneration and Other Functions

Board of Directors

Our Board of Directors makes decisions on important management matters related to the execution of business, supervises the execution of duties by directors, and strives to ensure the transparency of decision-making, efficiency, and fairness. The total number of directors is eight (including three outside directors). As a rule, the Board meets on a monthly basis and an extraordinary board as needed. The board's implementation status was 26 times in the fiscal year ended March 2021 and 18 times in the fiscal year ended March 2022. Based on the provisions of Paragraph 1 of Article 427 of the Companies Act, the Company has entered into an agreement with the three outside directors to limit their liabilities for Remuneration for damages under Paragraph 1 of Article 423 of the Companies Act to the extent provided by laws and regulations in the event they are in good faith and are not grossly negligent. To enhance business execution and supervisory systems, the Company has established the Nomination and Remuneration Advisory Committee, which is an advisory body to the Board of Directors and is chaired by an independent outside director. The purpose is to strengthen the independence, objectivity, and accountability of the functions of the Board of Directors relating to the nomination of directors, Remuneration, etc.

Number of attendances/attendance rate for the year ended March 31, 2021

| Title | Name | Number of Times Attended (Times) |

Attendance Rate (%) |

|---|---|---|---|

| Representative Director, President and CEO of ZOZO Corporation | SAWADA Kotaro | 18 | 100 |

| Director, Executive Vice President & CFO | YANAGISAWA Koji | 18 | 100 |

| Director, COO | HIROSE Fuminori | 18 | 100 |

| Director | KAWABE Kentaro | 18 | 100 |

| Director | OZAWA Takao | 18 | 100 |

| Outside Director | ONO Koji ※ | 18 | 100 |

| Outside Director | HOTTA Kazunori ※ | 18 | 100 |

| Outside Director | SAITO Taro ※ | 18 | 100 |

| Outside Audit and Supervisory Board member | IGARASHI Hiroko ※ | 18 | 100 |

| Outside Audit and Supervisory Board member | MOTAI Junichi ※ | 18 | 100 |

| Outside Audit and Supervisory Board member | UTSUNOMIYA Junko ※ | 18 | 100 |

※ Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

Audit and Supervisory Board, Audit and Supervisory Board members

We are a company with an Audit & Supervisory Board in accordance with the Companies Act. The Board of Directors monitors the operation of the Board of Directors and conducts audits of day-to-day activities, including the execution of duties by directors. The number of Audit & Supervisory Board members is three. All Audit & Supervisory Board Members are Outside Audit & Supervisory Board Members. Outside Audit & Supervisory Board Members are attorneys and certified public accountants, who use their respective experience and achievements to monitor management. In principle, the Audit and Supervisory Board member meets once a month, and the status of implementation was 18 times in the fiscal year ended March 2021 and 19 times in the fiscal year ended March 2022. In addition to attending the General Meeting of Shareholders and the Board of Directors and exercising legal rights, such as receiving reports from directors, executive officers, employees, and accounting auditors, the Audit & Supervisory Board members attend the Management Meeting and the Compliance Committee, etc., which are important committees, conduct audits by interviews with each department, and conduct on-site inspections of subsidiaries. The Audit & Supervisory Board members provide opinions that contribute to improving the soundness of our management in the course of daily audit operations. In addition, the Company actively exchanges opinions with accounting auditors, the Internal Audit Office and directors of subsidiaries, and information with SoftBank Group Auditors, our parent company, and others, to conduct effective and efficient auditing operations. In accordance with the provisions of Paragraph 1 of Article 427 of the Corporate Law, each Audit and Supervisory Board member has entered into an agreement to limit liability for Remuneration for damages under Paragraph 1 of Article 423 of the Corporate Law to the amount stipulated by law in the event that such Audit and Supervisory Board member is in good faith and is not grossly negligent.

| Title | Name | Number of Times Attended (Times) |

Attendance Rate (%) |

|---|---|---|---|

| Outside Audit and Supervisory Board member | IGARASHI Hiroko ※ | 19 | 100 |

| Outside Audit and Supervisory Board member | MOTAI Junichi ※ | 19 | 100 |

| Outside Audit and Supervisory Board member | UTSUNOMIYA Junko ※ | 19 | 100 |

※ Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

Management Meeting

As directors and executive officers, as well as observers, the the Management Meeting is composed of outside directors, general managers of divisions, full-time Audit and Supervisory Board member, representative directors of subsidiaries, and persons in charge of matters to be discussed as necessary. In principle, the the Management Meeting meets twice a month. The the Management Meeting makes resolutions, deliberations, and reports based on the decision-making authority standards. The the Management Meeting also collects and analyzes business reports in accordance with the Company's management policies and important information on these matters, shares information among departments, and conducts business plans, as well as matters to be discussed across the organization in terms of policies related to the overall business and issues faced by each business division. These meetings are implemented to contribute to decision-making by the representative directors and decision-makers based on the decision-making authority standards.

Nomination and Remuneration Advisory Committee

We have established the Nomination and Remuneration Advisory Committee as a voluntary committee for the purpose of expressing opinions to the Board of Directors on the nomination and remuneration of directors. The Nomination and Remuneration Advisory Committee consists of five members: all independent outside directors, one dispatched director from the parent company, and one executive director. The committee is chaired by an outside director. In accordance with the Nomination and Remuneration Advisory Committee Regulations established by the Board of Directors, the Nomination and Remuneration Advisory Committee presents its opinions to the Board of Directors on all other matters related to the appointment and dismissal of directors, the election and dismissal of the president, CEO and representative director, succession plans for the president and CEO, and deliberations based on the performance of each fiscal year and the contribution to this performance, etc.

The Nomination and Remuneration Advisory Committee consists of the following:

| ONO Koji | Outside Director (Chairperson) |

| HOTTA Kazunori | Outside Director |

| SAITO Taro | Outside Director |

| SAWADA Kotaro | Representative Director, President & CEO |

| KAWABE Kentaro | Director (Non-Executive) |

[Nomination and Remuneration Advisory Committee]

(1)Status of Activities

In the year ended March 31, 2022, five meetings were held and all members of each committee attended.

(2)Major Deliberations

・Determination of Nomination Criteria and Evaluation Methods for Executive Directors

・Conducting interviews with executive directors and nominees for directors

・Review and finalization of evaluation feedback content for all directors, etc.

・Determination of proposals for submission of reports to the Board of Directors with respect to candidates for Directors

・Examination of management structure in line with FY21's business strategy

・Considering the establishment of KPIs for short-term incentive Remuneration for FY21 executive directors

| Title | Name | Number of Times Attended (Times) |

Attendance Rate (%) |

|---|---|---|---|

| President and CEO | SAWADA Kotaro | 5 | 100 |

| Director | KAWABE Kentaro | 5 | 100 |

| Outsidel Director | ONO Koji ※ | 5 | 100 |

| Outside Director | HOTTA Kazunori ※ | 5 | 100 |

| Outside Director | SAITO Taro ※ | 5 | 100 |

※ Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

Inter-Group Trading Review Committee

From the viewpoint of ensuring fairness in transactions conducted by our group in consideration of the interests of minority shareholders, the purpose is to deliberate and examine important conflict of interest transactions between controlling shareholders and minority shareholders.

The Inter-Group Trading Review Committee is organized by our independent directors.

| ONO Koji | Outside Director |

| HOTTA Kazunori | Outside Director |

| SAITO Taro | Outside Director |

| IGARASHI Hiroko | Outside Audit and Supervisory Board member |

| MOTAI Junichi | Outside Audit and Supervisory Board member |

| UTSUNOMIYA Junko | Outside Audit and Supervisory Board member |

(1)Our Organizational Position

The Committee is positioned as an advisory body to the Board of Directors.

(2)Function

The Committee deliberates and examines important conflict of interest transactions, and decides the opinions of the Inter-Group Transaction Review Committee regarding whether important conflict of interest transactions are not disadvantageous to our minority shareholders, and provides advice and recommendations to our Board of Directors with the reasons.

Internal Audit Office

The Internal Audit Office, in collaboration with the Audit and Supervisory Board members and accounting auditor, strives to improve the effectiveness and efficiency of internal controls, compliance, etc. by conducting hearings and on-site surveys of each business division in accordance with the annual internal audit plan.

Auditing Firms, etc.

a. Name of the auditing corporation

Deloitte Touche Tohmatsu Limited.

b. Certified Public Accountants leading the independent financial audit

HIROSE Tsutomu

AWASHIMA Kunikazu

c. Assistant Organization in Audit Activities

Audit assistants engaged in accounting audits are nine certified public

accountants and 12 others.

Directors' Remuneration

Introduction of a Performance-Linked Remuneration System

The Nomination and Remuneration Advisory Committee, which is an advisory body to the Board of Directors and is composed mainly of outside directors, has been considering reviewing the remuneration system for directors. Based on the results of the deliberations and their reports, we have decided to revise the remuneration system for the executive directors of the Company to pay for their efforts to achieve short-term and medium-to long-term performance and increase corporate value based on our management strategy, and for their achievements, with the aim of encouraging the sustainable, medium-to long-term improvement of corporate value and functioning as a sound incentive. Specifically, it consists of fixed remuneration and performance-linked remuneration. Fixed remuneration consists of only cash and performance-linked remuneration consists of two types of remuneration: cash bonuses and stock-based remuneration. With regard to the percentage of each remuneration, the percentage of performance-linked remuneration exceeds the percentage of fixed remuneration, and the percentage of performance-linked remuneration that is cash bonuses and stock-based remuneration is set at half.

Remuneration

・Total remuneration paid to directors (of which, outside directors) 269 million yen (21 million yen)

・Total amount by type of remuneration, etc.

| Basic remuneration | Fixed remuneration | 165 million yen (21 million yen) |

| Bonus | 54 million yen (-) | |

| Non-monetary remuneration | Restricted stock | 50 million yen (-) |

・Number of eligible directors: 6 (including 3 outside directors)

・As of the end of the fiscal year under review, there were eight directors (of whom three were outside directors). The reason for the difference in the number of directors is that there are two non-compensated directors.

・Bonuses are the amount of provision for accrued bonuses to directors and Audit and Supervisory Board members for the current fiscal year. Details of performance indicators selected as the basis for calculating bonus amounts are merchandise transaction value and consolidated operating income. The reason we selected these performance indicators was that we emphasize merchandise transaction volumes and consolidated operating income as indicators of the growth and profitability of our Group's businesses.

・Performance-linked restricted stock awards are granted to directors as non-monetary remuneration.

Policy for Determining Remuneration Amounts and Calculation Method

Nomination and Remuneration Consolatory Committee regulations stipulate processes regarding decisions regarding specific procedures in determining remuneration for executive directors. After deliberation by the Nomination and Remuneration Advisory Committee, individual remuneration amounts are determined by resolution of the Board of Directors after comprehensive consideration of business performance, management content, economic conditions, and other factors based on the Committee's report. The Company's policy is to pay only fixed remuneration to outside directors. In addition, directors have no retirement benefit plans. (excluding those for which payment was decided prior to the abolition of the system) With respect to the share remuneration, in the case where the director subject to the restriction on transfer resigns his or her position as a director prior to the expiration of the restriction on transfer in the share allotment agreement concluded with the director subject to the payment, if it is found appropriate for us to find certain grounds, such as a provision to the effect that in the event that the director subject to the payment resigns his or her position as a director for a reason other than the reason deemed justifiable by the board of directors, or in the event that a certain cause of misconduct, etc. arises, we will necessarily acquire the allotted shares in whole or in part without consideration, or in the case that there is a mistake in the figures that serve as the basis for calculating the cancellation ratio of the restriction on transfer, the director subject to the payment shall establish a clause to require us to return all or a part of the shares subject to the restriction on transfer or money, etc. equivalent thereto without consideration.

Reasons for Election of Directors and Audit and Supervisory Board members

SAWADA Kotaro

Since joining the Company, SAWADA Kotaro have served as a representative director of a subsidiary and have been in charge of important business execution, management decision-making and supervision as a manager of the Marketing Division. Since September 2019, he has served as our representative and has sought to make swift and flexible decisions in business operations. He continues to be appointed as a director because he is qualified for the future growth of our Group and the realization of our corporate philosophy.

YANAGISAWA Koji

YANAGISAWA Koji has been strengthening the management foundation of the entire company by overseeing overall business management, including accounting, finance, investor relations, and legal affairs, as well as corporate governance and M&A. In addition, as a director and executive vice president, he continues to execute duties as a member of the Board of Directors and is expected to continue to execute duties from a wide range of perspectives. Accordingly, he has been elected as a director.

HIROSE Fuminori

Since joining the company, HIROSE Fuminori has served in a broad range of experiences and knowledge as General Manager of the Internal Audit Office, Executive Officer, General Manager of the Corporate Administration Division, and Executive Officer, General Manager of the EC Business Division, and has contributed to our growth. He was appointed as a director of the Company because it can be expected to contribute to enhancing the corporate value of the Company.

KAWABE Kentaro

KAWABE Kentaro has a wealth of experience and broad insight cultivated in the Internet services industry as a manager, and was appointed as a director of the Company to utilize this knowledge in the management of the Group.

OZAWA Takao

OZAWA Takao has a wealth of experience and broad insight cultivated in the Internet services industry as a manager, and was appointed as a director of the Company to utilize this knowledge in the management of the Group.

ONO Koji

ONO Koji monitors the management of the Company and strengthens corporate governance based on the wealth of experience and broad knowledge and perspectives cultivated through art direction centered on the fashion industry and branding activities for companies and products. In addition, the Company has determined that he is a person who has no personal, capital or business relationship with the Company and has no other interests, and is capable of fulfilling his duties as an outside director from an independent and objective standpoint. Therefore, the Company designates him as an independent director of the Company.

HOTTA Kazunori

HOTTA Kazunori contributes to the enhancement of corporate governance by having the Company supervise the management of the Company based on his abundant experience and broad insight accumulated in the wedding industry and the hotel industry, as well as providing advice to the Company's overall management. He also appointed an independent director because he judged that there was no risk of conflict of interest with general shareholders because he did not fall under any of the items a to l above.

SAITO Taro

SAITO Taro has extensive experience and broad insight into branding and communication design, and I would like to receive advice from a high perspective on the Group's branding strategy. In addition, the Company has determined that he is a person who has no personal, capital or business relationship with the Company and has no other interests, and is capable of fulfilling his duties as an outside director from an independent and objective standpoint. Therefore, the Company designates him as an independent director of the Company.

IGARASHI Hiroko

IGARASHI Hiroko has been qualified as a certified public accountant and has been involved in the duties of an accounting group manager at other companies. Accordingly, the Company has determined that she possesses considerable knowledge of finance and accounting and is able to properly perform such duties in the Company's audits. She is also appointed as an independent director because the Company judged that there was no risk of conflict of interest with general shareholders.

MOTAI Junichi

MOTAI Junichi has considerable knowledge of finance and accounting as an accountant and certified public tax accountant. Based on his deep insight and abundant experience as an expert, he conducts appropriate audits of our business execution from a neutral and fair standpoint. He is also appointed as an independent director because the Company judged that there was no risk of conflict of interest with general shareholders.

UTSUNOMIYA Junko

UTSUNOMIYA Junko has a considerable level of expertise as an attorney and in corporate legal affairs, so the Company determined she is able to conduct appropriate audits. She is also appointed as an independent director because the Company judged that there was no risk of conflict of interest with general shareholders.

Directors’ skills matrix

The knowledge and experience that directors are expected in responding to current or future management issues against the business environment at the company are as follows.

| Name | Title | Important knowledge and experience for Decision-making and Monitoring of the Board of Directors | Important knowledge and experience in Responding to Current and Future Management Issues | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management・ Management Strategy |

Finance・M&A | Treasury・Accounting | Organization・Human Resources | ESG・Sustainability | Corporate Governance | Compliance・Risk Management | Brand Strategy・Creative Strategy | (IT・Digital)Technology | Same Business・Same Industry | SupplyChain | Global Management・Business | Imagination and Creation(※) | ||

| SAWADA Kotaro | Representative Director, President & CEO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| YANAGISAWA Koji | Director, Executive Vice President & CFO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| HIROSE Fuminori | Director, COO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| KAWABE Kentaro | Director | ● | ● | ● | ● | ● | ● | ● | ||||||

| OZAWA Takao | Director | ● | ● | ● | ● | ● | ● | |||||||

| ONO Koji | Outside Director | ● | ● | ● | ● | ● | ||||||||

| HOTTA Kazunori | Outside Director | ● | ● | ● | ||||||||||

| SAITO Taro | Outside Director | ● | ● | ● | ● | |||||||||

※ ”Imagination and Creation” is translation of our original Japanese word “SOZO.” It stands for the ability to create new value, cultural values, and all types of excitement and surprise. In addition, this table does not represent all the knowledge and experience possessed by each director.

Our Corporate Governance Structure is below.

We have developed and maintained the internal whistleblower system, in order to minimize the damage that may occur to the Company by discovering acts that could violate the law, the internal regulations, social credibility at the early stage, prevent scandals and take appropriate countermeasures. We made efforts to make the system to function properly by setting up the contact points both inside and outside of the Company. The external lawyer will help through the external contact point and establish the reporting structure directly to the audit committee which is independent from the top management, allowing employees to make anonymous whistleblowing. Also, we treat the whistleblower and those who supported the investigations anonymously to preclude any repercussions. After the receipt of the report under the management of the compliance committee, whistle-blowing information will be strictly managed and conduct investigations and improvement measures.

In an effort to enhance an organization-wide risk management structure to function by identifying risks that may occur, the Company establishes the “Risk Management Regulations” to take appropriate approaches for various risks prevention and times of unexpected accidents.

ZOZO Group has established SDGs Promotion Committee in November 2020, as an advisory organization to the Board of Directors. The Committee is chaired by the President and CEO, and acts as a chief executive officer of environmental management responsible to oversee discussions regarding climate-related risk and opportunities, policies and goals, progress of initiatives, and to report to the Board of Directors important matters discussed at the SDGs Promotion Committee.

Basic Policy and Structures Regarding Internal Control Systems

We have established the Basic Policy on Internal Control Systems with regard to systems to ensure the appropriateness of operations as stipulated in the Companies Act and the Company Act Enforcement Regulations, and the Board of Directors has adopted a resolution. The overview of the meeting is as follows.

1. System to ensure that the execution of duties by our directors and employees complies with laws and the Articles of Incorporation

(1)In order for the execution of duties by our directors and employees to comply with laws, regulations, and the Articles of Incorporation, and to fulfill our corporate ethics and social responsibilities, we will establish and maintain a compliance committee chaired by the President and Representative Director to build and maintain a compliance system, prevent acts that violate laws and regulations, acts that may violate laws and regulations, or inappropriate transactions, and strengthen the legal compliance system for our directors and employees.

(2) Internal reporting system for directors and employees to report suspected violations of laws, regulations, and company regulations

A Help Line shall be established to detect and rectify improprieties at an early stage. The Compliance Committee shall investigate matters reported to the Help Line, and if any action requiring corrective action becomes clear, the Compliance Committee shall promptly decide and implement corrective measures and preventive measures.

(3) Necessary measures shall be taken so that a person who has made a notification as prescribed in the preceding item shall not be subjected to adverse treatment by reason of said notification.

(4) The Internal Audit Office shall investigate the compliance system, investigate whether there are any legal or articles of incorporation problems, and report them to the Board of Directors and the Audit and Supervisory Board.

(5) The Board of Directors shall regularly review the compliance system and strive to identify and improve problems.

(6) The Audit and Supervisory Board shall audit the effectiveness and functions of this internal control system in an effort to identify and rectify issues at an early stage.

2. System for the storage and management of information related to the execution of duties by our directors

(1) The storage and management of information pertaining to the execution of the duties of our directors shall be appropriately managed and stored in writing or by electromagnetic media in accordance with laws and regulations, Information System Management Guideline and Document Management Guideline.

(2) The Audit and Supervisory Board members can constantly inspect this information.

3. Rules and Other Systems for Managing the Risk of Loss

(1) Our Chief Risk Management Officer shall be a Director and Executive Vice President, and as appropriate, Directors, Executive Officers, General Managers of Related Divisions and Directors shall identify and evaluate various risks in accordance with the Risk Management Guideline, and take necessary measures in advance to avoid, mitigate or transfer risks.

(2) The Internal Audit Office shall audit the risk management status of each organization and report the results to the Board of Directors and the Audit and Supervisory Board members.

(3) The Board of Directors shall regularly review the risk management system and endeavor to identify and improve problems.

4. System to ensure that the execution of duties by our directors is efficient

(1) Clarify the duties and responsibilities of directors and each department by stipulating the Board of Directors Guideline, Organizational Guideline, Guideline on Division of Responsibilities, and Job Authority Guideline, etc. In addition, the Board of Directors Guideline stipulates matters to be submitted to the Board of Directors, as well as the range within which each director can make decisions, and establish a system to ensure that directors perform their duties efficiently.

(2) The President and Representative Director drafts the annual management plan based on the Budget Management Guideline, and receives approval from the Board of Directors. The director in charge of each division determines the specific measures to be implemented by each division and the efficient business execution system based on the plans determined.

(3) The President and Representative Director reports regularly to the Board of Directors on the progress of the annual management plan, and the Board of Directors analyzes and improves the relevant measures and factors that hinder the efficient business execution system.

5. System to ensure the appropriateness of operations in the corporate group consisting of us and its subsidiaries (hereinafter referred to as "our group")

(1) One or more directors or corporate auditors of subsidiaries are dispatched from us to monitor, supervise or audit the execution of duties by directors of subsidiaries. The Business Management Division shall be in charge of the business operations of subsidiaries, the development of compliance systems and risk management systems, and other business management of subsidiaries in accordance with the Subsidiary Management Guideline. Regular reports on the status of business to us and appropriate approvals for important matters shall be obtained, while respecting the autonomy of the management of subsidiaries.

(2) The Internal Audit Office shall conduct internal audits of the status of management of our subsidiaries and the business activities of our subsidiaries.

6. In cases where a Audit and Supervisory Board member requests the appointment of an employee who is to assist in the duties of the Audit and Supervisory Board member, matters concerning the system concerning such employee, matters concerning the assurance of effectiveness for such employee, and matters concerning independence from the director

(1) In the event that a Audit and Supervisory Board member requests the appointment of an employee to assist the Audit and Supervisory Board member, the board of directors may, in consultation with the Audit and Supervisory Board member, appoint such employee as an employee to assist the Audit and Supervisory Board member. During such period of assistance as may be designated by the Audit and Supervisory Board member, the authority to direct the appointed employees shall be transferred to the Audit and Supervisory Board member and shall not be subject to the direction of the directors.

(2) The prior consent of the Audit and Supervisory Board member shall be obtained with respect to personnel changes, personnel evaluation, and disciplinary actions of employees who are to assist the Audit and Supervisory Board member.

7. System for Directors and Employees of the Group to Report to Audit & Supervisory Board Members and Other Systems for Reporting to Audit & Supervisory Board Members

(1) The directors and employees of our group shall, in addition to recognizing matters that may cause significant damage to us, fraud, important laws and regulations, and violations of the Articles of Incorporation, report important matters and decisions to be submitted to the Board of Directors, important accounting policies, accounting standards and changes thereof, the status of implementation of internal audits, important monthly reports, and other important matters to the Audit & Supervisory Board Members in accordance with laws, regulations, and internal regulations.

(2) Necessary measures shall be taken so that a person who has made a report set forth in the preceding item shall not be subjected to adverse treatment on the grounds that he/she has made said report.

8. Other Systems to Ensure Effective Audits by Audit and Supervisory Board members

(1)Audit & Supervisory Board members shall attend meetings of the Board of Directors and the The Management Meeting in order to ascertain the important decision-making process and the status of business execution, attend other important meetings, inspect important documents related to business execution, such as application documents, and request explanations to directors and employees.

(2) The Audit & Supervisory Board Members shall ensure the effectiveness of audits through their independence and authority based on the Rules of the Audit & Supervisory Board and the Audit & Supervisory Board Standards, and ensure that audits are conducted effectively while maintaining close cooperation with the Internal Audit Office and the Accounting Auditor.

(3) The President and Representative Director meets regularly with the Audit & Supervisory Board to exchange opinions on issues to be addressed by the Company, the status of improvement of the environment for Audit & Supervisory Board Members' audits, and important auditing issues, and to promote mutual communication.

(4)In cases where a request for payment is made with respect to the procedures for advance payment or reimbursement of expenses arising from the execution of the duties of Audit and Supervisory Board member or any other expenses or obligations arising from the execution of such duties, the payment shall be made promptly.

9. Structure to Eliminate Antisocial Forces

We will eliminate any relationships with antisocial forces or organizations that threaten social order or the sound activities of corporations, cooperate with external specialist organizations such as the police and counsel, and take a firm stance toward responding to unfair demands in an organized manner.

10. System to Ensure the Reliability of Financial Reporting

In order to ensure the reliability of financial reporting, establish, maintain, and operate a system that enables internal control over financial reporting to function effectively.

Basic Approach and Systems to Exclude Anti-Social Forces

ZOZO Group's basic policy is to eliminate any transactions with antisocial forces and organizations that threaten social order and the sound activities of companies, and to cooperate with external specialist organizations such as the police and counsel, while taking a firm stance toward responding to unfair demands in an organized manner. To prevent any relationship with antisocial forces, the Legal Department of the Group conducts surveys before commencing transactions with new suppliers, new subcontractors, etc. In accordance with the standards subsequently established, we have established procedures to conduct surveys by external investigative organizations. After implementing these procedures, we have established a system to commence transactions. In addition, we conduct surveys of existing business partners at least once a year to ensure that we are able to collect information on an ongoing basis.

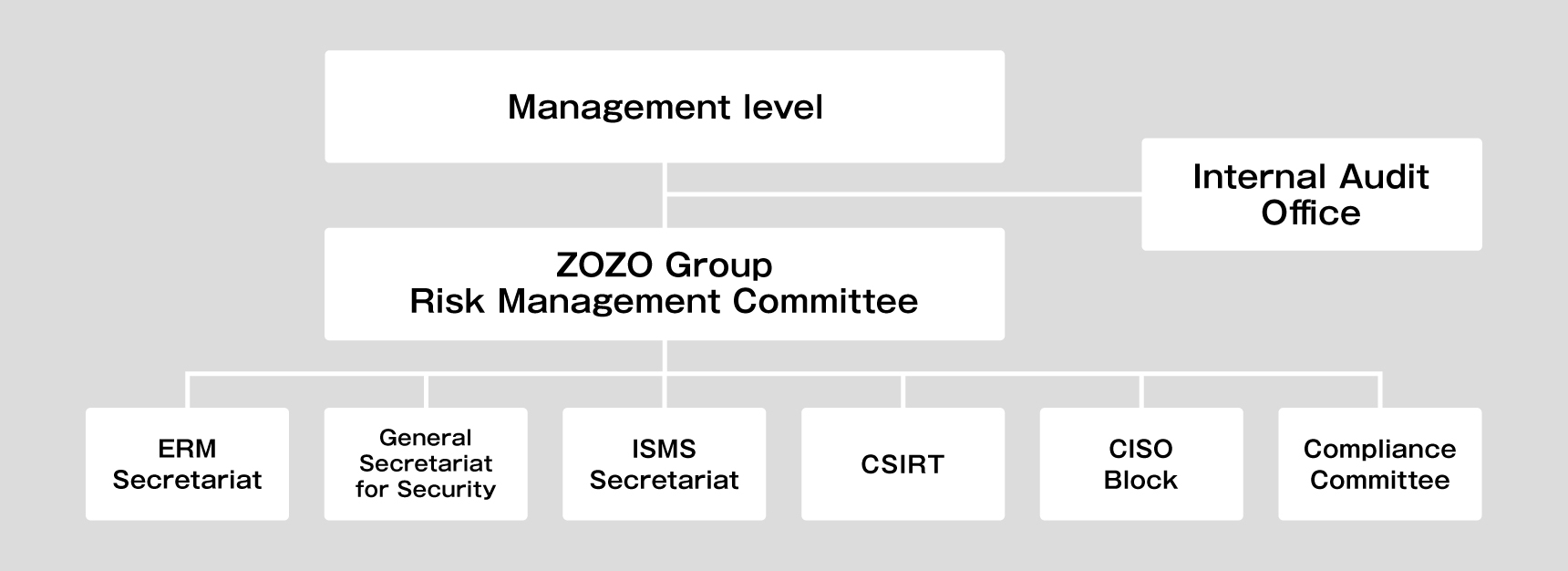

ZOZO Group is committed to security throughout the company so that customers can use our services safely and with peace of mind. In addition, ZOZO Group Risk Management Committee has been established to promote group-wide risk reduction activities and to function as a committee and promote these activities. The committee accurately recognizes, identifies, and responds to a wide range of risks related to business activities.

ZOZO Group Risk Management Committee

ZOZO Group Risk Management Committee conducts risk management across the Group. There are further subcommittees in the committee, and operations carried out in each area are across the Group.

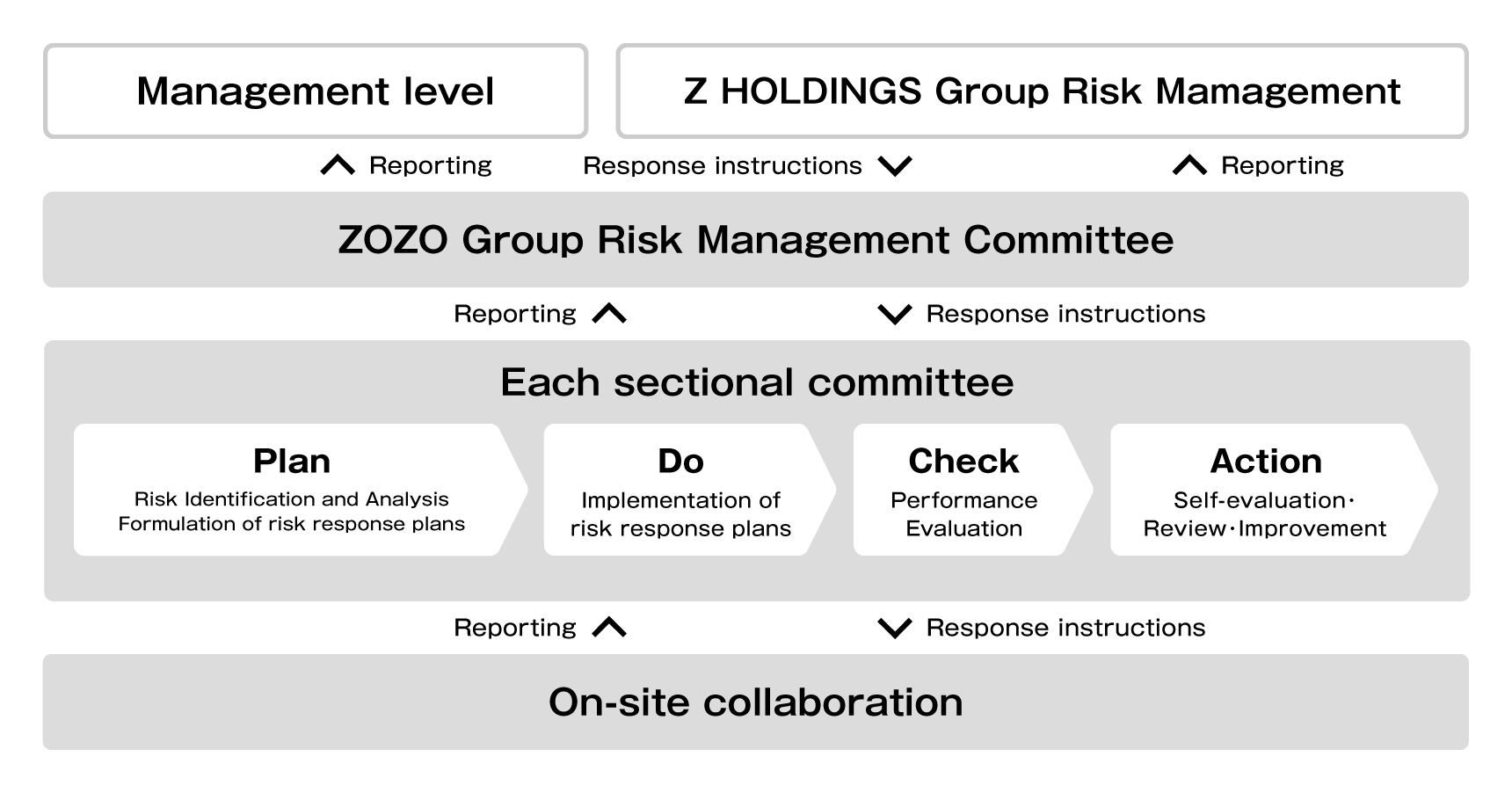

Operations of ZOZO Group Risk Management Committee are conducted according to the following flow. We cooperate with the Z Holdings Group.

ZOZO Group recognizes that it is an important responsibility to properly protect the information assets held by the Group, including information entrusted by customers using its services, from various threats to information security. Based on this philosophy, the Group has formulated a basic policy for information security, and by implementing this policy, we declare that we will actively work to establish, operate and maintain an information security management system.

1. ZOZO Group will comply with laws, regulations and other codes of conduct concerning information security.

2. Through ISMS's activities, we will take organizational, human, physical and technical safety control measures, engage in information security measures, and firmly establish them.

3. ZOZO Group will continuously review and improve its management system for information security in light of changes in social and environmental conditions.

May 28, 2021

ZOZO, Inc.

Representative Director, President & CEO

SAWADA Kotaro

Information Security Training

To raise awareness of information security among all ZOZO employees, we conduct training on information security through e-learning to raise awareness. (Held once in fiscal 2020)

Achieving ISMS Certification

Based on the above basic information security policy, ZOZO Group has been audited by a third-party organization and has acquired ISO/IEC 27001:2013, an international standard for information security management systems (ISMS), and JIS Q 27001:2014, a Japanese domestic standard.

Certified Standards

ISO/IEC 27001:2013 / JIS Q 27001:2014

Registration No.

IS 749678

IS 749678 / ISO 27001

Scope of Registered Certification

Operations described below for web-based services for BtoB and BtoC

・Planning, development and operation

・Customer Support

・Operation of logistics centers

・Technological development, R&D

・Production and production support for apparel products

Date of Certification

July 15, 2021

Expiration Date

July 14, 2024

Examination and Certification Institution

BSI Group Japan K.K.

ZOZO CSIRT

ZOZO CSIRT is an organizational CSIRT(Computer Security Incident Response Team of ZOZO Group. It is a member of the Nippon CSIRT Association.

Background and Background of Establishment

ZOZO Group has been striving to establish and thoroughly implement information management for many years. ZOZO CSIRT was established in April 2019 and joined the Japan Seasat Council in July of the same year, with the aim of enhancing information security initiatives as well as operating teams to respond to diversifying incidents, in addition to increasing the number of employees in addition to expanding the service offered.

Activities

ZOZO Group has established a basic information security policy to achieve the objectives of ISMS (Information Security Management System).

ZOZO Corporation and its subsidiaries and affiliates that adopt this policy and use personal information jointly (the "Group") provide a variety of services businesses (hereinafter referred to as "Services"), including Internet shopping websites.

Our group recognizes the importance of personal information for customers using our services as well as all those who provide personal information to our group.

I hereby declare that I will comply with the laws and other regulations concerning the protection of personal information, establish voluntary rules and systems, and establish, implement and maintain a privacy policy that includes the following matters.

1. Our Group will comply with the Act on the Protection of Personal Information (hereinafter referred to as the "Act") and other related laws and regulations, guidelines and other norms stipulated by the national government with regard to the handling of personal information and personal information of employees, etc. handled by all businesses. In addition, we will formulate an information management system in accordance with the Japanese Industrial Standards "ISMS conformity assessment scheme" (ISO 27001) to protect personal information.

2. When acquiring and using personal information, our group will identify the purpose of its use, and will not handle personal information beyond the scope necessary for achieving the specified purpose of use (non-purpose use). In addition, we will take appropriate management measures to avoid non-purpose use.

3. Our group shall not provide any personal information obtained to a third party with the consent of the person in question, except in accordance with laws and regulations, etc.

4. When we receive complaints and inquiries about the handling of personal information, we will promptly investigate the facts and respond in good faith within a reasonable period of time.

5. In order to properly manage personal information acquired, our group will take organizational, human, physical and technical safety measures to prevent the leakage, destruction or damage of personal information and to rectify it. In addition, we will promptly dispose of the personal information of our customers when the storage period specified by law has passed and when we no longer need to handle the personal information of our customers.

6. In light of changes in social and environmental conditions, the Group will continuously review its personal information protection management system for personal information protection and improve its efforts to protect personal information.

Established September 1, 2006

Revised July 3, 2009

Revised January 31, 2018

Revised on November 29, 2018

Revised on December 1, 2019

Revised on June 28, 2021

Revised on November 5, 2021

Revised on March 30, 2022

SAWADA Kotaro

Representative Director, President and CEO

ZOZO, Inc.

ZOZOTOWN Usage Rules include "handling of personal information," "managing IDs and passwords," etc.

Compliance Committee

The Compliance Committee is established and convened for the purpose of formulating ethical behavior standards, preparing and implementing legal compliance manuals and compliance programs, as well as conducting operations such as checks. The aim is to foster a corporate culture that emphasizes compliance throughout the Company and to establish a company that is trusted by stakeholders.

Compliance Training

To raise awareness of compliance among all ZOZO employees, we conduct compliance-related training through e-learning to raise awareness. (Held twice in fiscal 2020)

Prohibition of Bribery and Entertainment and Gifts

We prohibit illegal provision of profits to public officials and others in order to prevent bribery activities in accordance with the "Regulations Governing the Management of Entertainment Expenses." We also prohibit companies from engaging in cross-disciplinary entertainment and giving gifts to customers, suppliers, and other outside parties excluding those between affiliated companies.

For Fair Trade

In order to comply with the Antimonopoly Act and the Subcontract Act, we conduct compliance training to raise awareness and raise awareness of the issue so as not to use unreasonable restraint of trade or unfair trade practices that are subject to regulation. In addition, we confirm whether we comply with the Subcontracting Act in the procedures for internal contract review and conclusion.

Prohibition on Conflicts of Interest

The Company has established "Guideline to ensure the fairness of transactions with the parent company group" for transactions with major shareholders, etc. and operates in accordance with these rules. With respect to transactions with major shareholders, etc., the Company shall comply with laws and regulations, and shall not conduct such transactions on terms unjustly favorable or disadvantageous to the Group as compared to the same, the same kind of or similar transactions conducted with third parties, and shall reasonably determine such transactions by taking into account the terms of the contract and market price as in the case of transactions with other companies.